.png)

By submitting your email address you agree to receive marketing emails from Juni. We won’t overdo it or use your data for anything other than sending emails - and you can unsubscribe at any time.

“Have I paid that vendor yet?” you ask yourself as you sort through the dozens of invoices you’ve received this month. Definitely not the way you wanted to spend your Friday afternoon.

As your small business grows, manually managing accounts payable (AP) processes becomes more challenging, time-consuming and error-prone.

Enter accounts payable software. These platforms can automate processes like invoice management and payment processing while syncing to your accounting software to ensure nothing slips through the cracks.

This article offers an overview of the six best accounts payable software solutions for small businesses so you can find just the right platform for your needs. We’ll also give you a list of the features you should look for when choosing a platform, plus tips for how to make your decision.*

Financial admin eating up too much of your time? We can take it off your plate

Automate your accounts payable processes with Juni and free up your day for more impactful work.

*The information about all the platforms discussed in this article was collected between 9 January 2024 and 11 January 2024. This article was written and approved by Juni and is intended as marketing material.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Whenever you’re researching software, whether that be an accounts payable solution or inventory management platform, you need to be clear on what functionalities your business needs. So before we get into our list, here are some features you should prioritise when selecting accounts payable software:

Let’s take an in-depth look at our list of software. For each platform, we’ll list its features (as well as its limitations), explain how pricing works and point out what kind of business it’s best fit for.

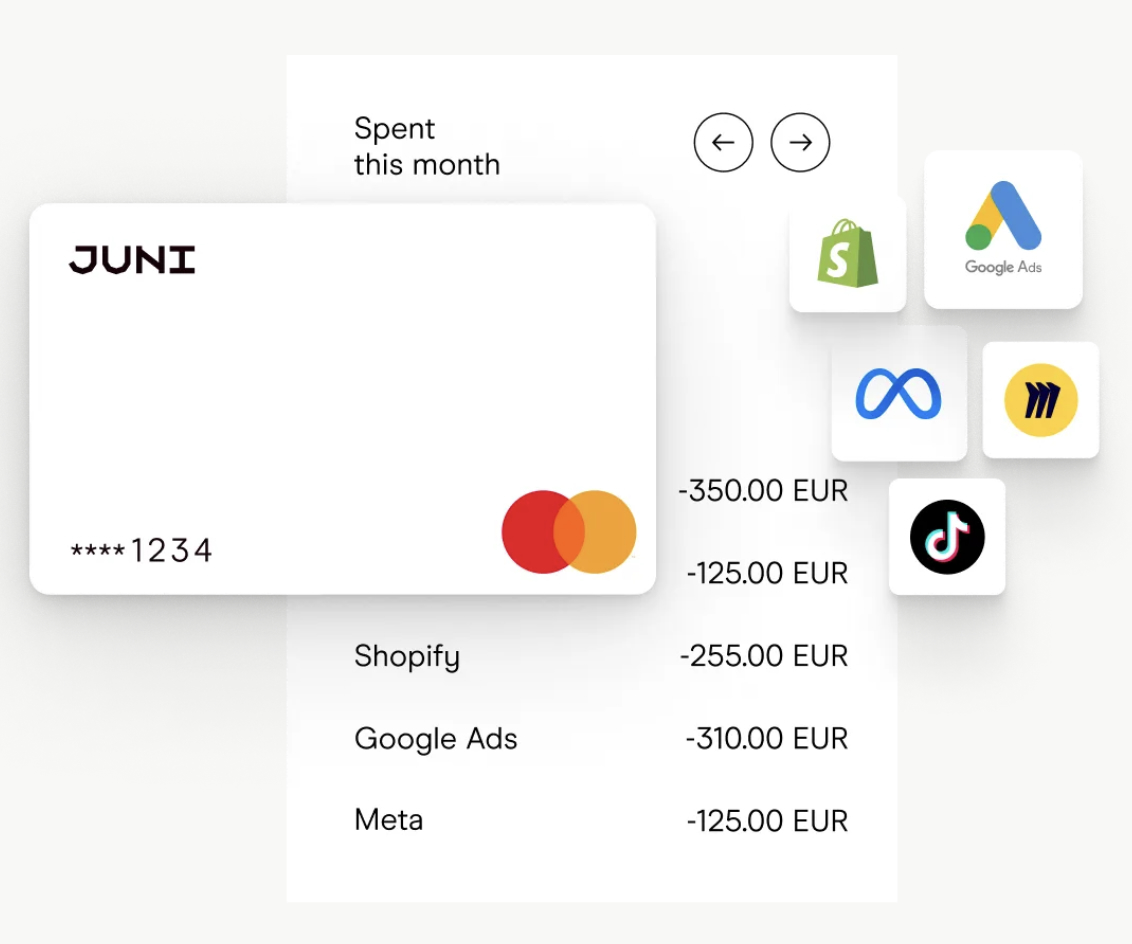

Juni’s platform for ecommerce entrepreneurs comes with automated accounts payable features that can help you run simpler, tighter and more accurate financial admin. With Juni, it takes just seconds to auto-collect, pay and even finance your invoices.

By collecting and scanning your invoices automatically, then pre-filling all the important payment details, Juni saves you time and reduces the risk of human error. You can also automatically import your receipts and invoices with your dedicated Juni inbox for effortless spend management, plus match receipts to transactions.

What’s more, if you need to reduce pressure on your cash flow cycles, Juni offers financing options for certain types of payments, giving you up to 120 days to pay.*

The platform goes beyond accounts payable features, also offering business accounts and cards, features to optimise cash flow management, powerful accounting automations, fast transfers and storefront integrations.

Most suitable for: Ecommerce entrepreneurs and small businesses

Juni has two plan options:

You can try our Scale plan for free for the first 30 days.

Based in Copenhagen, Pleo is a business spending solution with built-in AP automation software. Pleo’s invoice management features make it easy to capture, process, approve, pay and bookkeep invoices in a central location. With over 50 supported currencies, Pleo users can seamlessly pay vendors across the world.

Most suitable for: Companies that need to pay invoices in several currencies

Pleo has three plan options:

Spendesk is a spend management platform with accounts payable features like invoice automation and approval workflows, giving you greater control over the invoicing lifecycle and your AP processes. By using Spendesk, you can minimise (or eliminate) manual data entry for your invoicing processes, plus get real-time insights into your spending patterns.

Most suitable for: SaaS, tech and fintech companies

Spendesk doesn’t list its pricing options, so you’ll have to reach out to sales to get a quote

Sage Intacct’s cloud-based invoicing software helps small business owners and finance teams automate invoice management with the power of AI. For example, simply upload or email an invoice, and the software will automatically extract details and populate fields for your approval. The platform can also detect duplicate invoices, helping you stay in control of your expenses and avoid costly errors.

Most suitable for: Businesses that need powerful analytics tools

Sage Intacct has three plans for its accounts payable software. All plans come with three months free:

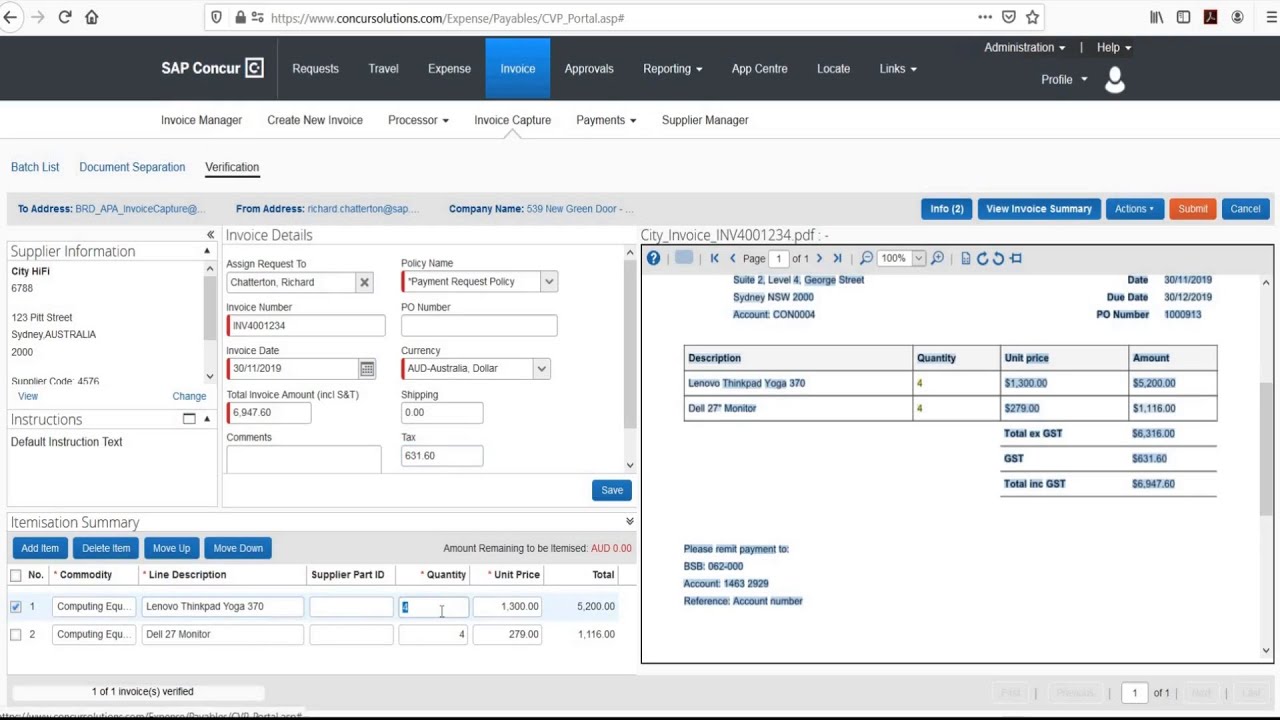

While SAP Concur isn’t specifically designed for small businesses, it’s still a good fit for solopreneurs and SMBs looking to automate their AP processes. The platform automates invoicing processes, meaning you can pay suppliers quickly without constantly having to double-check invoices and complete transactions yourself.

Most suitable for: Businesses with immediate plans to scale

SAP Concur doesn’t list its pricing options, so you’ll have to reach out to sales to get a quote.

Visma is the parent organisation for a number of accounting and invoicing solutions across Europe. It has designated products for 15 different EU countries, such as Visma eKonomi, its designated Swedish accounting platform. Visma eKonomi has basic AP features for paying vendors, but it has a range of other accounting features that can help you streamline your financial admin as a whole.

Most suitable for: Small businesses in Sweden

Visma platform prices range depending on which country you operate in and the Visma product you select. Visma eEkonomi has three plans that come with supplier invoicing features:

You can have all the software comparison guides in the world available to you, but if you aren’t intentional about your decision, you may end up choosing software that falls short for your needs. Here are a few steps you can take to help you make the right decision when selecting an accounts payable platform for your small business.

By digitising the traditionally paper-intensive process of handling invoices and payments, AP software is not only more efficient than manual processes, but also minimises the possibility of errors, like a missed or incorrect payment. Having more visibility over invoices, due dates and your general spending patterns can help you maintain tighter control over your financial operations.

But to get the most out of a platform, you need to make sure you’re choosing the right one for your needs. For example, if you run an online storefront, you’ll want to choose a solution like Juni that has the specific needs of ecommerce entrepreneurs in mind.

By choosing a software solution that’s a good fit for you, you’ll make your business more agile, resilient and competitive. Meanwhile, you’ll get back more time in the day to focus on what you most love about running your company, whether that’s marketing your product, interacting with customers or finding ways to scale.

Financial admin eating up too much of your time? We can take it off your plate

Automate your accounts payable processes with Juni and free up your day for more impactful work.

*Juni Invoices is available for EU-based companies only. Media financing is available for companies registered in NL, SE, DE, FR, ES, IT, FI and NO, upon eligibility. Fees and terms and conditions apply. Click here for more details.

Accounts payable automation software helps businesses manage and track the money they owe to suppliers, vendors and other parties. Essentially, this type of software helps business owners and finance departments handle their payment processes by recording invoices, tracking due dates and organising information.

While you can manually manage your accounts payable process, this approach can be time-consuming and error-prone. A better way to keep track of accounts payable is by using specialised accounts payable software that tracks and pays your invoices for you.

You can automate accounts payable processes by using specialised software. These platforms handle a number of tasks, including:

"Only six more to go," you tell yourself as you upload yet another receipt to your accounting software. We all know the pain of searching for receipts across emails and platforms and trying to match them to expenses.

This becomes even more challenging the larger your business becomes and the more vendors you have to pay. You can avoid most of that frustration and wasted time with the right spend management software.

But not all spend management platforms will be a good fit for your business. For example, digital commerce companies need solutions that take into account sector-specific expenses like ad receipts and multiple platform payments, while small businesses need tools that simplify their financial admin, not complicate it.

This article takes a look at the six best spend management software solutions so you can find just the right platform for your needs. We’ll also give you a list of the features you should look for when choosing a platform, plus tips for how to make your decision.*

Spend less time on spend management

With real-time spend overviews, receipt matching automation and powerful integrations, Juni will make you forget what a hassle managing your expenses used to be.

*The information about all the platforms discussed in this article was collected between 17 January 2024 and 19 January 2024. This article was written and approved by Juni and is intended as marketing material.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Before taking a closer look at the tools on our list, here are six features your spend management software (also known as expense management software) should come with:

Bonus: Look out for spend management platforms that come with built-in accounts payable and invoice automation features, which will help you centralise your financial admin and save time.

Now, let's explore the solutions on our list in depth. For each platform, we’ll list its key features (as well as its limitations), explain how pricing works and point out what kind of business it’s best fit for.

Juni helps businesses in digital commerce manage their cash flow, track their expenses and optimise their profits with features that are specifically designed with ecommerce companies in mind.

While it’s not specifically expense management software, you can use the platform for your spend management needs. Juni's goal is to give everyone in digital commerce, from the CFO to the accounting team to marketing managers, everything they need to focus on business growth.

Juni’s expense management features are especially valuable for users who have multiple receipts coming from different media buying channels and online transactions. With Meta and Google Ads integrations, plus powerful receipt matching, expense management suddenly becomes easy. On top of that, you can also manage your unpaid invoices and accounts payable processes within Juni, bringing your financial admin under one roof.

All of this comes with easy access to media and inventory financing for up to 2 million EUR, helping you free up your cash flow and grow your business.*

*Juni Invoices is available for EU-based companies only. Media financing is available for companies registered in NL, SE, DE, FR, ES, IT, FI and NO, upon eligibility. Fees and terms and conditions apply. Click here for more details.

Most suitable for: SMBs and mid-market companies in digital commerce

Juni has two plan options:

SAP Concur helps you streamline processes to deliver efficiency savings, with a focus on eliminating manual data entry, lost receipts and unclaimed VAT refunds. As such, it’s best suited to larger organisations. The platform helps you reduce the risk of human error and compliance issues with automations, plus the software can identify potential mistakes and discrepancies in real-time.

Most suitable for: Larger and enterprise organisations

SAP Concur doesn’t list its pricing options, so you’ll have to reach out to sales to get a quote.

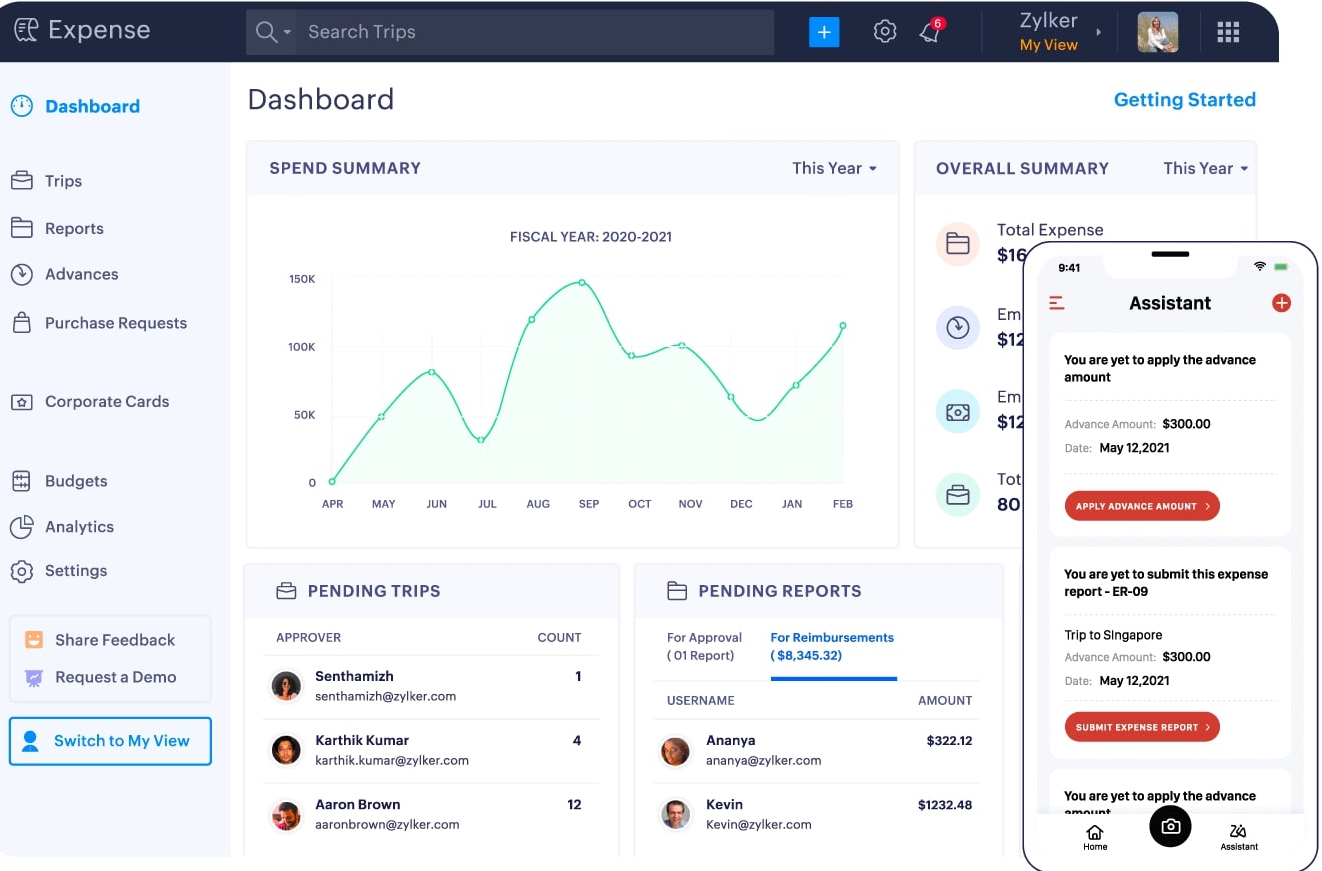

Zoho Expense is the business expense tracking app from the Zoho suite of business tools, which means it integrates with Zoho’s other financial management apps. It’s a reasonably priced platform suited to handling all aspects of expense management and reporting for SMBs. Zoho Expense automatically records expenses from receipts, simplifying and automating the expense reporting process.

Most suitable for: People already using other Zoho products (namely Zoho Books)

Zoho Expense has three plans for its spend management software:

Expensify is a spend management solution for keeping track of business expenses on the go. Most of the expense management functionality can be done on your phone, while a series of handy integrations help to automate and streamline processes around uploading and allocating receipts. Plus, it’s easy for employees to create and submit expense reports for quick reimbursement.

Most suitable for: Small businesses with lots of employee expenses

Expensify has two plans:

One of the many features of smart accounting software QuickBooks is its built-in expense management tool. There are obvious advantages to expenses being handled via your accounting platform, like how easy it is to claim business expenses for tax purposes. And when you connect your bank to the platform, QuickBooks automatically matches and organises your receipts to transactions.

Most suitable for: Businesses who want more comprehensive accounting tools built into their spend management software

Quickbooks has five plans:

Fortnox is a cloud-based accounting software platform based in Sweden that helps businesses manage their accounting and bookkeeping processes, as well as other financial admin like spend management. Users can take photos of receipts and instantly upload them via a mobile app, and the platform automatically fills in date, amount and VAT.

Most suitable for: Businesses that operate in Sweden

Fortnox has three plans:

The information in this guide can help you make your decision, but ultimately, you need to factor in considerations about your business and its needs when choosing a platform. Here are three things you can do to ensure you’re choosing an ideal solution.

As you’ll notice from the list above, different software solutions are more suitable for different business industries and sizes. For example, Juni is spend management software built with the needs of ecommerce companies in mind. So when researching a platform, pay close attention to what type of business (big or small, ecommerce or SaaS) it’s best suited for.

While it shouldn’t be the only factor that guides your decision, you can’t ignore pricing when choosing a solution. You need to find a healthy balance between a platform you can afford (and doesn't go over budget) that still gives you all the key features and functionalities you need to run smarter, more efficient financial admin.

You may be a small business now, but if you have plans of scaling in the future, you want to make sure your expense management solution can scale with you. Juni, for example, caters to both SMBs as well as mid-market companies, meaning we can provide the solutions you need from the time your business is founder-led to when it has 100+ employees.

While you can never remove expense management from your to-do list, you can find a platform that does most of the work for you. The best spend management software is one that not only simplifies financial operations but also contributes to strategic decision-making and the long-term financial health of your organisation.

To find a platform that does all that, you need to make sure you’re making your selection with the unique needs of your business in mind. For example, if you operate in digital commerce, you want to choose a solution like Juni that comes with ecommerce-specific capabilities, like features designed specifically for media buying and online transactions.

So take your time finding the right platform—doing so can lead to significant time savings and valuable insights into spending patterns, helping you improve the overall financial health and success of your business.

Spend less time on spend management

With real-time spend overviews, receipt matching automation and powerful integrations, Juni will make you forget what a hassle managing your expenses used to be.

Spend management software is a platform or tool that helps businesses manage and control their expenses. This type of solution usually includes features for receipt management, expense reporting and approval workflows. Plus, these platforms often integrate with accounting software, as well as sync with banks and credit cards.

There are a number of benefits to using spend management software to control your expenses, including:

The price of expense management software varies depending on the size of your business and what industry you operate in, as this will impact which platform you choose. Prices range from as low as £7 per month to almost £100, and some spend management systems also offer free plans to certain users.

The current economic climate brings increased focus on managing expenses and financial efficiency. As a result, many finance teams are preparing for the worst.

Financial planning is a good way to prepare for possible outcomes. In our previous article, on mastering cash flow forecasting, we took you through how to forecast your finances with three scenarios: a base case, an upside case, and a downside case.

So, what do you do if you’re on the way to your worst-case scenario?

Forecasting will provide you with benchmarks to know which scenario you’re heading towards. You need to ensure you have the right KPIs and regularly monitor your finances. Choosing which KPIs are most meaningful for your business can give you fair warning before things get critical and you need to take drastic action.

For example, if your downside case is -50% of your gross margin, and you notice three months into the period you’re tracking at -20%, you may need to take action.

If you’re moving towards a downside case, you may consider reducing fixed costs, being ruthless about what generates business and what doesn’t, and looking at credit solutions. When cutting costs, you generally want to avoid several smaller subsequent cuts by being thorough in the first place.

In many cases, the first place to start making changes is by reducing your variable, and where possible fixed, costs to run your business in a leaner way. An in-depth understanding of your expenses can help you understand where your capital is going and how you can cut back.

Here are some common areas for improvement:

● Renegotiate with or switch suppliers.

● Reduce running costs like energy, internet, and communications.

● Cut unnecessary expenses such as redundant subscriptions.

● Consider where you can optimise transport and storage.

● Monitor your marketing and prioritise top-performing campaigns.

● Consider remote working to cut down on office size and overheads.

● See whether outsourcing work will reduce costs or alternatively reduce contractor’s days.

When looking at where to cut costs, a deep understanding of your finances and access to the right data from across your organisation is crucial. It’s also essential to understand each business area's operations. Looking solely at numbers is one thing, but you want to ensure that teams can still function with a reduced budget.

Financial automation tools like Juni, expense management software, and accounting automation can reduce the complexity of putting financial information together so you can focus on turning it into usable insights.

Being ruthless about what generates business requires an understanding of other business KPIs and starts to blur the line between CFO and COO. Looking at business efficiencies also considers variable costs too.

Finance teams need to understand the business in a detailed way to recommend operational changes to reach your desired financial state. In practice, this could mean reducing your assortment by cutting underperforming products, reducing your number of SKUs or changing your business model.

It’s also important to turn numbers into usable insights. Tracking KPIs and noticing a decrease is one thing, but understanding why and how to rectify it is another.

For example, if revenue has dropped 10% since the previous month, simply demanding an increase of 10% the following month may be useless to other teams. You need to understand who you’re communicating with and choose a KPI they can act on. Instead, investigate. In this example, sales were down because it took customers longer than anticipated to complete the checkout process, with some abandoning it altogether. You can then focus efforts on fixing the issue.

If you’ve cut costs and improved organisational efficiencies and you’re still in need of cash, credit solutions can help with your runway. There are many options to choose from, and it’s key to understand which is best suited to your business needs.

Loans, credit cards and overdrafts are longstanding methods of securing funding, but they’re susceptible to changing interest rates in the current climate.

Revenue-based financing allows borrowers to repay a loan as an agreed percentage of gross monthly profits instead of at a fixed rate.

Credit lines can offer flexible financing to ease your cash flow.

It’s important to consider the long-term impact of securing financing, especially on how interest rates could be affected in the coming year. Although a fixed-rates could seem appealing, securing this when interest rates are high could mean you’re paying more than you can afford when the rates come back down.

Before taking any drastic actions, it’s essential to forecast the outcome and continue to track your KPIs to measure if it’s successful.

Continually monitoring and optimising your expenses can be critical to a successful strategy to turn around a downward trajectory

By submitting your email address you agree to receive marketing emails from Juni. We won’t overdo it or use your data for anything other than sending emails - and you can unsubscribe at any time.